Fundamentals of Wealth Creation with Kaitlyn Carlson

SOWBO’s membership gathered this month for a training session with Kaitlyn Carlson entitled “Fundamentals of Wealth Creation for Women Entrepreneurs” to answer questions about creating, managing, and protecting wealth.

Recently, SOWBO members have been asking financial questions like . . .

I am making money; what should I do with it?

How do I create REAL, generational wealth?

How can I move from making a profit to investing wisely?

Should I reduce my tax liability?

Why is long-term financial planning important? Where do I start?

So, we reached out to Kaitlyn who is a certified financial planner and accredited wealth manager as well as founder and CEO of Theory Planning Partners, a boutique wealth creation firm built exclusively for the top female entrepreneurs in the United States. She brought her experience, knowledge, and ability to clearly explain complicated financial issues to enable SOWBO members to become more savvy and make wiser financial decisions.

Wealth Creation: Starting With the End in Mind

Part of Kaitlyn’s motivation for starting Theory Planning Partners was the number of people who were blindsided at the end of their careers. While they had worked hard and obtained professional success, they had not properly prepared for retirement. The result was either a delay in retirement or a significantly lower income in retirement.

Kaitlyn reminded us that one day we will all have to separate from our business. The goal is to have financial independence to do that when you want and in the way you want.

How? By creating a financial plan that allows you to accumulate assets over time that will replace your need to work.

Steps to Creating a Financial Plan

Create a financial plan by asking yourself three questions: Where are you now? Where do you want to go? How will you get there? Once you have these answers, you are ready to make an actionable financial plan.

Where are you now?

First, take a realistic look at your finances.

What is your net worth? Find this by subtracting your liabilities (student loans, car notes, mortgage, credit card debt) from your assets (business, house, car, checking account, retirement accounts). This is your net worth.

Then, calculate your cash flow by subtracting your expenses (cost of living) from your income (salary, distributions). Are you at a net gain or net loss each month?

Where do you want to go?

With a clear picture of your finances, look at your business.

What are you working for? Is yours a lifestyle business that requires you to save to secure financial independence? Or, is it an enterprise business that you are building to sell and will provide you savings when you sell?

Also, think about what is fulfilling for you now and what you look forward to in the future. What legacy do you want to leave?

As a business owner, it is easy to get caught up in the day-to-day operations and not get the 30,000 ft view. It is essential to get that view!

How will you get there?

Depending on your age, you have a variety of options on building the wealth you need for financial independence. You can make more, spend less, or back up your retirement date.

Good habits, according to Kaitlyn, are the key to being wealthy. She also encouraged automation in order to put money aside before there is a chance to spend it unnecessarily.

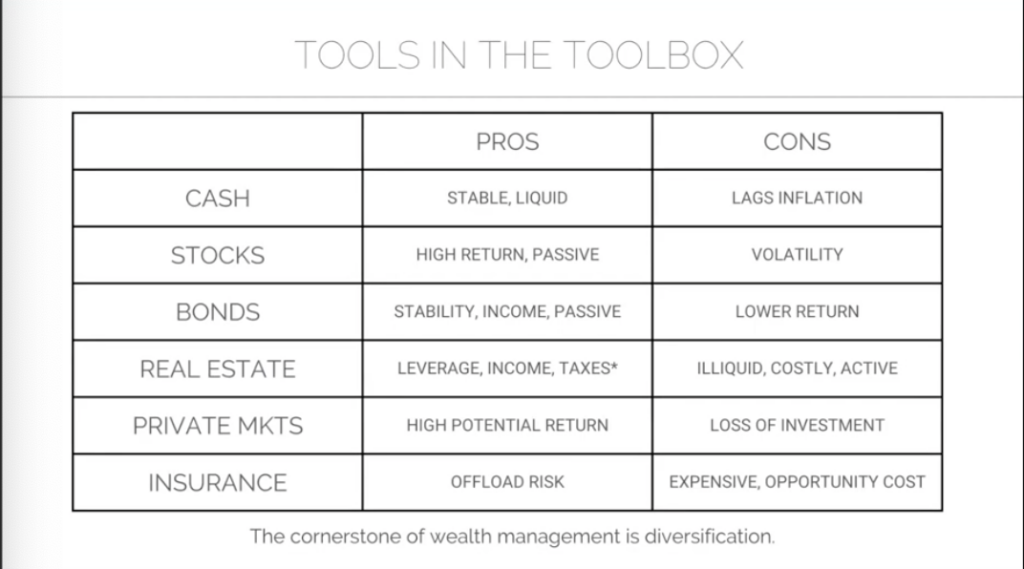

Tools in the Toolbox

Here is a graphic, provided by Kaitlyn, of some of the best financial tools. While there are pros and cons to every economic environment, diversification helps business owners weather any economic-political climate.

Wealth Creation Team

And, another great piece of advice from Kaitlyn: if you find that financial issues are outside your zone of genius, build a wealth creation team, including:

- Insurance Agent

- CFP

- Bookkeeper

- CPA

- Corporate Attorney

- CFO

- Estate Planner

- Retirement Specialist

Steps for Wealth Creation

Finally, Kaitlyn shared the order of investing for someone who is just getting started in business:

#1 Cover living expenses.

#2 Save 3-6 months of living expenses in cash.

#3 Manage your debt effectively.

#4 Get clarity on your financial goals.

#5 Save and invest. Remember, once your business grows beyond your living expenses, you don’t want to grow your expenses; instead, you want to start saving.

#6 Optimize taxes.

#7 Protect yourself as you build your wealth by having strong advisors and good insurance.

#8 Monitor and adjust.

#9 Automate and stay the path.

#10 Be curious and talk to experts.

Want More? Join SOWBO!

We appreciate Kaitlyn Carlson bringing her expertise and experience to SOWBO.

If you want more of this kind of insight and information, become a SOWBO member. You will have access to all our upcoming member-exclusive training sessions.

Find out more about SOWBO membership and join today!